An Educational Platform for Trading Research

We’re on a mission to make trading knowledge accessible to everyone. We conduct independent research and share our studies to help people learn and grow their understanding of global financial markets.What Kind of Trader Do You Want to Be?

Access our library of quantitative research, including derivatives pricing quizzes, and educational trading strategies.Advanced Mathematics for Trading Research$C = S_0 N(d_1) - K e^{-rT} N(d_2)$

$d_1 = \frac{\ln(S_0 / K) + (r + \frac{\sigma^2}{2})T}{\sigma \sqrt{T}}, \quad d_2 = d_1 - \sigma \sqrt{T}$

// Black-Scholes formula for European call option

double BlackScholesCall(double S, double K, double T, double r, double sigma) {

double d1 = (log(S / K) + (r + 0.5 * sigma * sigma) * T) / (sigma * sqrt(T));

double d2 = d1 - sigma * sqrt(T);

return S * NormalCDF(d1) - K * exp(-r * T) * NormalCDF(d2);

}$C - P = S_0 - K e^{-rT}$

// Put-Call Parity relation

double PutCallParity(double callPrice, double S, double K, double r, double T) {

return callPrice - S + K * exp(-r * T);

}$N(x) = \frac{1}{2} \operatorname{erfc}\left(-\frac{x}{\sqrt{2}}\right)$

// Approximate CDF for the standard normal distribution

double NormalCDF(double x) {

return 0.5 * erfc(-x / sqrt(2));

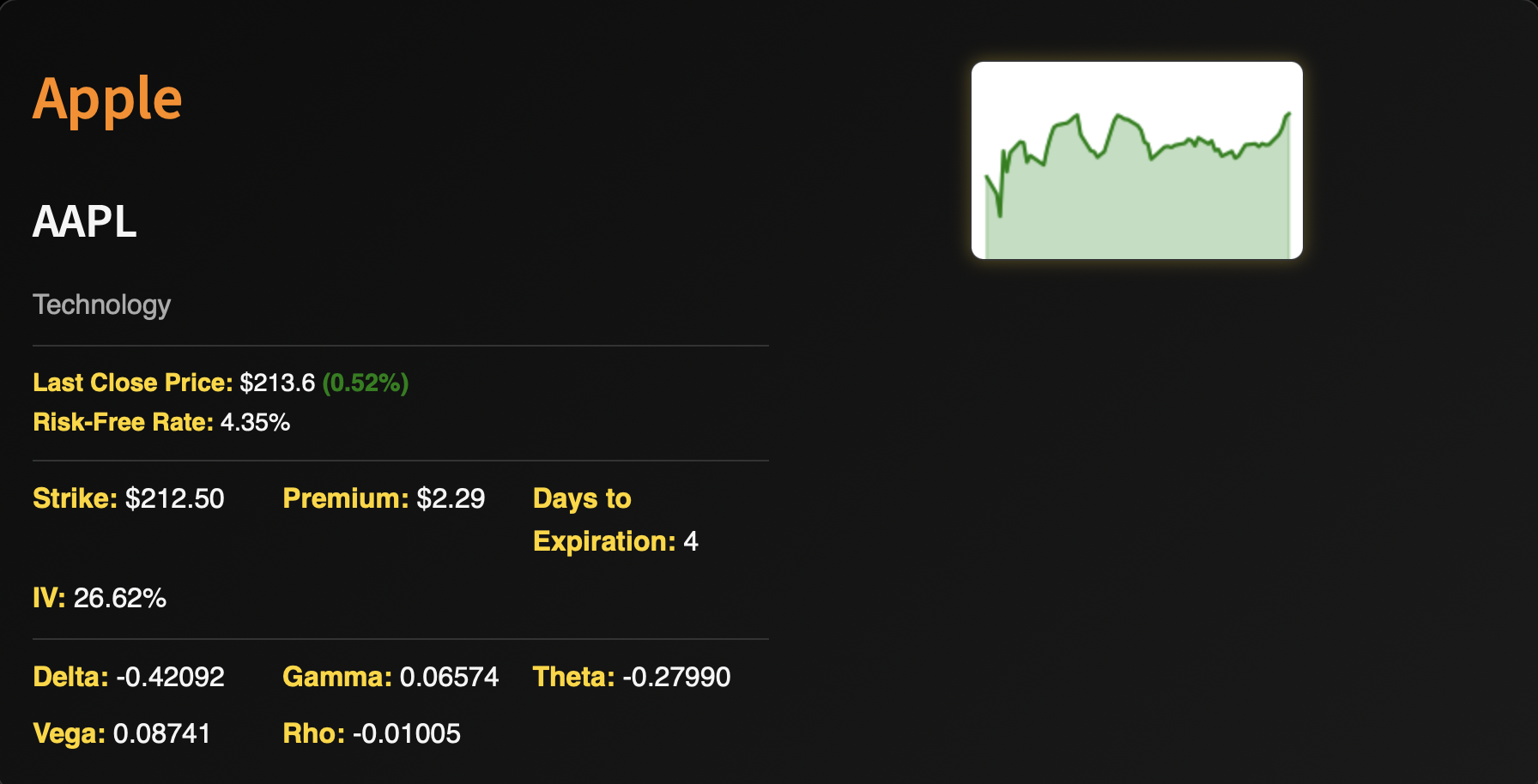

}Options Pricing Calculator — Live Now!

Options Dashboard

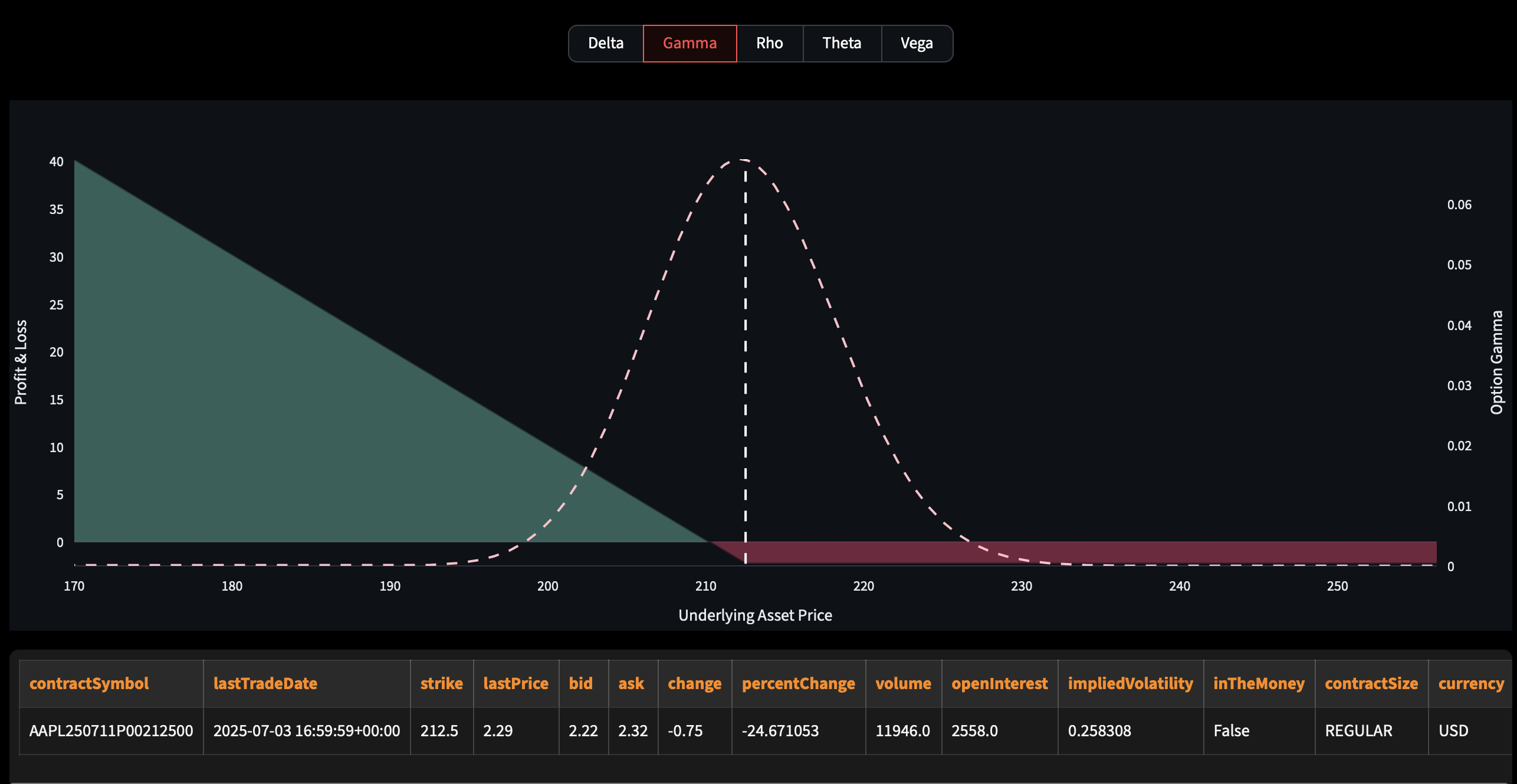

Options Profit & Loss

Options Greeks